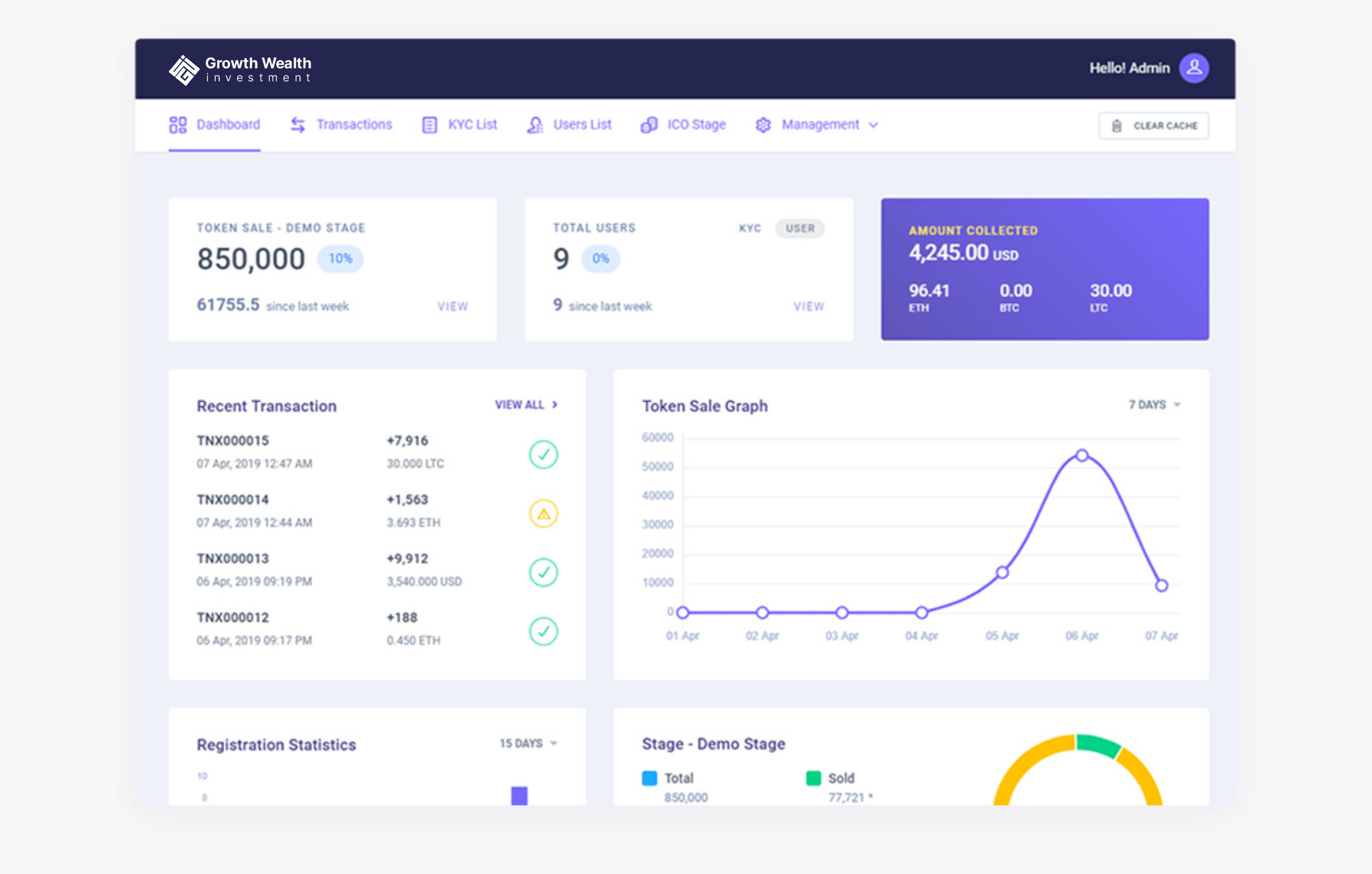

DeFi Treasury!

Enabling corporations to allocate part of their Treasury reserves into DeFi protocols that are currently yielding anywhere from 3% to 15%.

What is DeFi Treasury?

All over the world there are trillions of dollars sitting in corporate treasures. These balances earn nothing. In some cases they have to pay banks for the privilege of holding their cash.

Some corporations such as MicroStrategy are plugging their entire treasuries into bitcoin. That’s great when you control the majority of the voting shares. No one can fire you when Bitcoin suffers through its eventual volatility. But is there any CFO you know of that will risk an 85% drop in treasury value?

No. There isn’t. That’s why Growth Wealth Investment Fintech offers a product called “DEFI Treasury”.

We think this “middle path” of partial allocation to the hefty yields now being seen in defi protocols is a sensible approach most CFO’s can get behind.

We are incredibly excited about the future growth of DEFI but we are also tempering our excitement against the realities of how corporations make capital allocation decisions.

We think this “middle ground messaging” will resonate at scale with CFO’s across the world.